F3 Exam Dumps - Financial Strategy

Searching for workable clues to ace the CIMA F3 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s F3 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

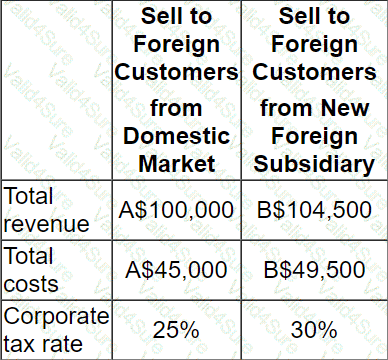

A company is considering either directly exporting its product to customers in a foreign country or setting up a subsidiary in the foreign country to manufacture and supply customers in that country.

Â

Details of each alternative method of supplying the foreign market are as follows:

Â

There is an import tax on product entering the foreign country of 10% of sales value.

This import duty is a tax-allowable deduction in the company's domestic country.

The exchange rate is A$1.00 = B$1.10

Â

Which alternative yields the highest total profit after taxation?

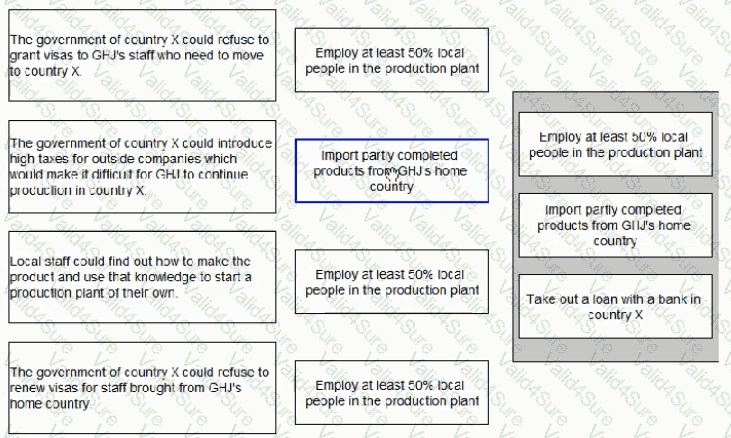

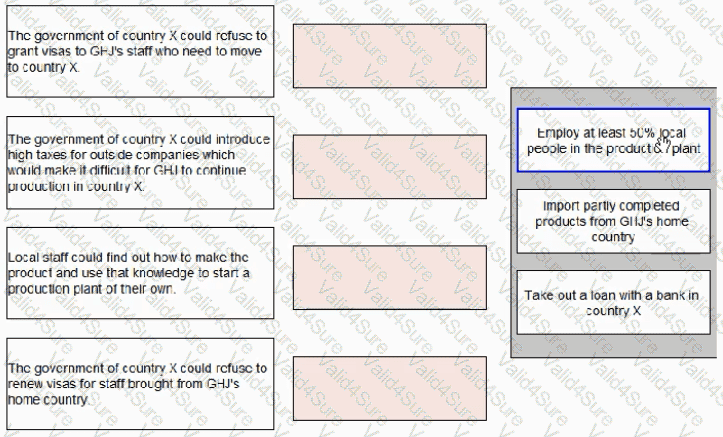

CI IJ has decided to move its production plant to overseas country X. This would make the product cheaper to produce. The technology used to make the product is very advanced and some of the skilled staff would have to move to country X.

The Production Director has identified that there are some political risks in moving to county X.

For each of the political risks of moving to country X shown below, select the correct method for reducing the risk.

The competition authorities are investigating the takeover of Company Z by a larger company, Company Y.

Both companies are food retailers.Â

The takeover terms involve using a part cash, part share exchange means of payment.

Company Z is resisting the bid, arguing that it undervalues its business, while lobbying extensively among politicians to sway public opinion against the bidder.

Â

Which of the following actions by Company Y is most likely to persuade the competition authorities to approve the acquisition?

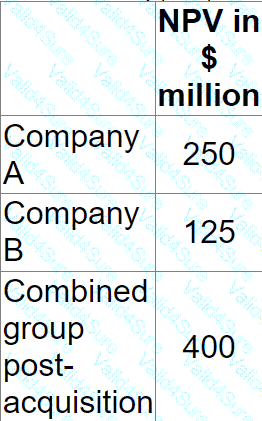

Company A is planning to acquire Company B by means of a cash offer. The directors of Company B are prepared to recommend acceptance if a bid price can be agreed. Estimates of the net present value (NPV) of future cash flows for the two companies and the combined group post acquisition have been prepared by Company A’s accountant. There are as follows:

What is the maximum price that Company A should offer for the shares in Company B?

Give your answer to the nearest $ million

A publicly funded school is focused on providing Value for Money

It pays its leaching staff less than other schools, because class sizes are generally smaller than elsewhere Despite some staff demotivation from low pay, exam pass rates are high given the close one-to-one attention many pupils receive.

On which aspect of Value for Money is the school underperforming?

Two unlisted companies TTT and YYY are being valued. The companies have similar capital structures and risk profiles and operate in the same industry sector It is easier to value TTT than to value YYY because there have recently been several well-publicised private sales of TTT shares.

Relevant company data:

What is the best estimate of YYY's share price?

Which TWO of the following situations offer arbitrage opportunities?

A)

B)

C)

D)

Company A has just announced a takeover bid for Company B. The two companies are large companies in the same industry_ The bid is considered to be hostile.

Company B's Board of Directors intends to try to prevent the takeover as they do not consider it to be in the best interests of shareholders

Which THREE of the following are considered to be legitimate post-offer defences?