F3 Exam Dumps - Financial Strategy

Searching for workable clues to ace the CIMA F3 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s F3 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

Which THREE of the following remain unchanged over the life of a 10 year fixed rate bond?

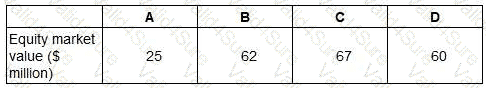

Company Z has identified four potential acquisition targets: companies A, B, C and D.

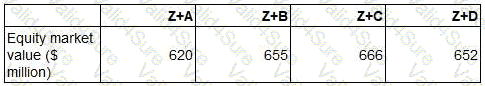

Company Z has a current equity market value of $590 million.

The price it would have to pay for the equity of each company is as follows:

Only one of the target companies can be acquired and the consideration will be paid in cash.

The following estimations of the new combined value of Company Z have been prepared for each acquisition before deduction of the cash consideration:

Ignoring any premium paid on acquisition, which acquisition should the directors pursue?

Using the CAPM, the expected return for a company is 10%. The market return is 7% and the risk free rate is 1%.

What does the beta factor used in this calculation indicate about the risk of the company?

A company has accumulated a significant amount of excess cash which is not required for investment for the foreseeable future.

It is currently on deposit, earning negligible returns.

Â

The Board of Directors is considering returning this excess cash to shareholders using a share repurchase programme.

The majority of shareholders are individuals with small shareholdings.

Â

Which THREE of the following are advantages of the company undertaking a share repurchase programme?Â

AÂ is a listed company. Its shares trade on a stock market exhibiting semi-strong form efficiency.

Â

Which of the following is most likely to increase the wealth of A's shareholders?