F3 Exam Dumps - Financial Strategy

Searching for workable clues to ace the CIMA F3 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s F3 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

Company X is an established, unquoted company which provides IT advisory services.

The company's results and cashflows are growing steadily and it has few direct competitors due to the very specialised nature of it's business. Dividends are predictable and paid annually.

Company PÂ is looking to buy 30% of company X's equity shares.

Â

Which TWO of the following methods are likely to be considered most suitable valuation methods for valuing company P's investment in Company X?

A company is wholly equity funded. It has the following relevant data:

• Dividend just paid $4 million

• Dividend growth rate is constant at 5%

• The risk free rate is 4%

• The market premium is 7%

• The company's equity beta factor is 1.2

Calculate the value of the company using the Dividend Growth Model.

Give your answer in $ million to 2 decimal places.

$Â ? Â million

A listed company is planning a share repurchase.Â

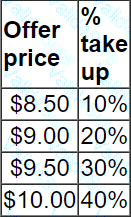

Research into different offer prices has given the following data with regards acceptance by the shareholders at different prices:

Â

Â

What price should be offered to shareholders if the retained earnings of the company are to remain unchanged?

Which of the following would be a reason for a company to adopt a low dividend pay-out policy?

Company WWW is considering making a takeover bid for Company KKA Company KKA's current share price is $5.00

Company WWW is considering either

" A cash payment of $5.75 for each share in Company KKA

" A 5 year corporate bond with a market value of $90 in exchange for 15 shares in Company KKA

Calculate the highest percentage premium which Company KKA shareholders will receive.

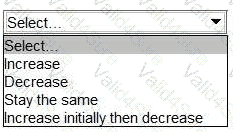

A company's directors plan to increase gearing to come in line with the industry average of 40%. They need to know what the effect will be on the company's WACC.

According to traditional theory of gearing the WACC is most likely to:

A company is planning to issue a 5 year $100 million bond at a fixed rate of 6%.

Â

It is also considering whether or not to enter into a 10 year $100 million swap to receive 5% fixed and pay Libor + 1% once a year.

Â

The company predicts that Libor will be 4% over the life of the 5 years.

Â

What is the impact of the swap on the company's annual interest cost assuming that the Libor prediction is correct? Â