F3 Exam Dumps - Financial Strategy

Searching for workable clues to ace the CIMA F3 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s F3 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

LPM Company is based in Country C. whose currency is the CS

It has entered Into a contract to buy a machine in three months' time. The supplier is overseas and the payment is to be made in a different currency from the CS

The treasurer at LPM Company is considering using a money market hedge to manage the transaction risk associated with a payment.

The assumptions of interest rate parity apply

Which THREE of the following statements concerning the use of a money market hedge for this supplier payment are correct?

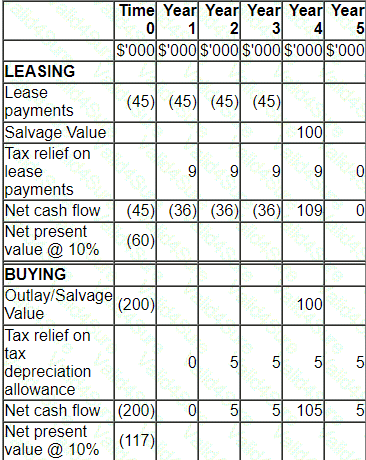

A company plans a four-year project which will be financed by either an operating lease or a bank loan.

Lease details:

• Four year lease contract.

• Annual lease rentals of $45,000, paid in advance on the 1st day of the year.

Other information:

• The interest rate payable on the bank borrowing is 10%.

• The capital cost of the project is $200,000 which would have to be paid at the beginning of the first year.

• A salvage or residual value of $100,000 is estimated at the end of the project's life.

• Purchased assets attract straight line tax depreciation allowances.Â

• Corporate income tax is 20% and is payable at the end of the year following the year to which it relates.

A lease-or-buy appraisal is shown below:

Â

Which THREE of the following items are errors within the appraisal?Â

A company has 6 million shares in issue. Each share has a market value of $4.00.

$9 million is to be raised using a rights issue.

Two directors disagree on the discount to be offered when the new shares are issued.

• Director A proposes a discount of 25%Â

• Director B proposes a discount of 30%

Â

Which THREE of the following statements are most likely to be correct?

M is an accountant who wishes to take out a forward rate agreement as a hedging instrument but the company treasurer has advised that a short-term interest rate future would be a better option.

Which of the following is true of a short-term interest rate future?

When valuing an unlisted company, a P/E ratio for a similar listed company may be used but adjustments to the P/E ratio may be necessary.

Â

Which THREE of the following factors would justify a reduction in the proxy p/e ratio before use?Â

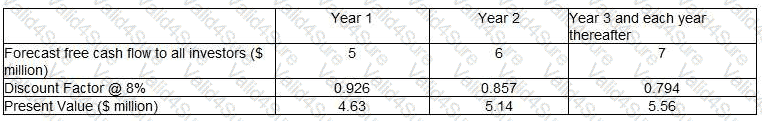

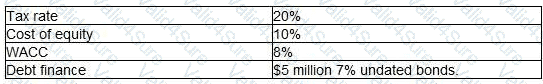

Company BBB has prepared a valuation of a competitor company, Company BBD. Company BBB is intending to acquire a controlling interest in the equity of Company BBD and therefore wants to value only the equity of Company BBD.

The directors of Company BBB have prepared the following valuation of Company BBD:

Value of Equity = 4.63 + 5.14 + 5.56 = S15.33 million

Additional information on Company BBD:

Which THREE of the following are weaknesses of the above valuation?

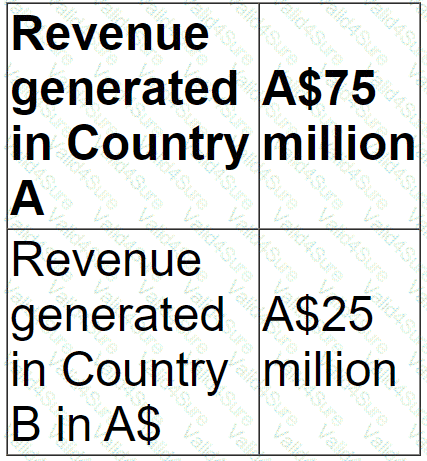

Company X is based in Country A, whose currency is the A$.

It trades with customers in Country B, whose currency is the B$.

Company X aims to maintain its revenue from exports to Country B at 25% of total revenue.

Â

Company A has the following forecast revenue:

The forecast revenue from Country B has assumed an exchange rate of A$1/B$2, that is A$1 = B$2.

Â

If the B$ depreciates against the A$ by 10%, the ratio of revenue generated from Country BÂ as a percentage of total revenue will:

Company HJK is planning to bid for listed company BNM

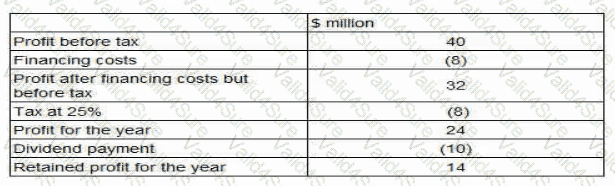

Financial data for BNM for the financial year ended 31 December 20X1:

HJK is not forecasting any growth in these figures for the foreseeable future

Profit and cost data above should be assumed to be equivalent to cash flow data when answenng this question

Which THREE of the following approaches would be most appropriate for HJK to use to value the equity of BNM?