F3 Exam Dumps - Financial Strategy

Searching for workable clues to ace the CIMA F3 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s F3 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

A listed company is planning to raise $21.6 million to finance a new project with a positive net present value of $5 million.  The finance is to be raised via a rights issue at a 10% discount to the current share price.  There are currently 100 million shares in issue, trading at $2.00 each.

Â

Taking the new project into account, what would the theoretical ex-rights price be?

Â

Give your answer to two decimal places.

Â

$Â ? Â

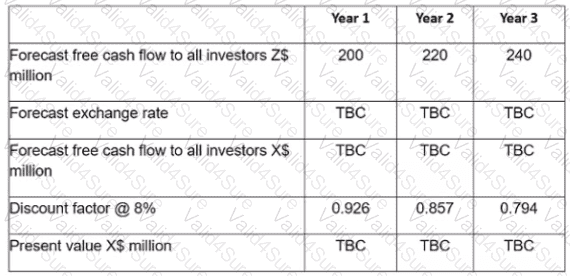

Company XXY operates in country X with the X$ as its currency. It is looking to acquire company ZZY which operates in country Z with the Z$ as its currency.

The assistant accountant at Company XXY has started to prepare an initial valuation of Company ZZY's equity for the first 3 years, however their valuation is incomplete. TBC' in the table below indicates that her calculations have yet to be completed.

The following information is relevant:

What is the correct figure (to the nearest million S) to include in year 3 as the present value in X$ million?

A company has stable earnings of S2 million and its shares are currently trading on a price earnings multiple {PIE) of 10 times. It has10 million shares in issue.

The company is raising S4 million debt finance to fund an expansion of its existing business which is forecast to increase annual earnings straight away by 25% and then remain at that level for the foreseeable future. The corporation tax rate is 20%. It is expected that the P/E will reduce to 8 times over the next year.

What is the most likely change in shareholder wealth resulting from this plan?

Which THREE of the following statements are correct in respect of the issuance of debt securities.

An unlisted company.

• Is owned by the original founders and members of their families

• Pays annual dividends each year depending on the cash requirements of the dominant shareholders.

• Has earnings that are highly sensitive to underlying economic conditions.

• Is a small business in a large Industry where there are listed companies with comparable capital structures

Which of the following methods is likely to give the most accurate equity value for this unlisted company?

Company WWW is identical in all operating and risk characteristics to Company ZZZ. but their capital structures differ. Company WWW and Company ZZZ both pay corporate income tax at 20%

Company WWW has a gearing ratio (debt: equity) of 1:3 Its pre-tax cost of debt is 6%.

Company ZZZ Is all-equity financed. Its cost of equity is 15%

What is the cost of equity tor Company WWW?

An unlisted software development business is to be sold by its founders to a private equity house following the initial development of the software. The business has not yet made a profit but significant profits are expected for the next three years with only negligible profits thereafter. The business owns the freehold of the property from which it operates. However, it is the industry norm to lease property.

Which THREE of the following are limitations to the validity of using the Calculated Intangible Value (CIV) method for this business?

Company M is a listed company in a highly technical service industry.

The directors are considering making a cash offer for the shares in Company Q, an unquoted company in the same industry.

Â

Relevant data about Company Q:

• The company has seen consistent growth in earnings each year since it was founded 10 years ago.

• It has relatively few non-current assets.

• Many of the employees are leading experts in their field. A recent exercise suggested that the value of the company's human capital exceeded the value of its tangible assets.

The directors and major shareholders of Company Q have indicated willingness to sell the company.

Before negotiations become too advanced, the directors of Company M are considering the benefits to their company that would follow the acquisition.

Â

Which THREE of the following are the most likely benefits of the acquisition to Company M's shareholders?