LLQP Exam Dumps - Life License Qualification Program (LLQP)

Searching for workable clues to ace the IFSE Institute LLQP Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s LLQP PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

Ten years ago, Anastasia purchased a $125,000 10-year term renewable life insurance policy. Her insurance need has not changed, and she is still in good health. She asks her insurance agent Raphael what she should do.

Andrea, owner of Andrea’s Fashions Inc., employs her designer daughter Judy, who will carry on the business after Andrea is gone. Wishing to ensure that the business would not suffer financially when Andrea passes away, Andrea decides at age 50 to have her business own, pay for, and be the beneficiary of life insurance on Andrea's life. The type of insurance that best suits is non-convertible Term 10 life insurance renewable until age 80.

What should her life insurance agent advise regarding this policy?

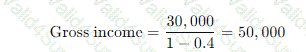

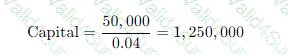

Oliver, an insurance agent, meets with Roman and Julie. They are a married couple with a five-year-old son William. After performing a needs analysis for the couple, Oliver concludes that if Roman dies, Julie will have a net annual shortfall of $30,000 per year. Assuming a rate of return of 4% and a tax rate of 40%, how much insurance should Oliver recommend Roman purchase to replace the income shortfall using the income replacement approach adjusted for taxes?

Adèle retired a few months ago. She sold some of her assets and would like to use the funds to take out a term annuity to increase her retirement income. Adèle brings a $300,000 cheque to Germain, her financial security advisor, and wants to begin receiving lifetime guaranteed benefits in one month with the right to use capital in the event of an emergency. When Germain tells her about alienating capital, the capitalization phase, and the payment phase, Adèle becomes confused and asks for clearer explanations. What can Germain say to help Adèle understand?

Alana, Meaghan, and Beatrice are equal shareholders of Advanced Tech Inc. They each own 100 shares of the company. Each share is currently worth $5,000. They recently signed a cross-purchase buy-sell agreement that is funded by life insurance. What will happen under this agreement if Alanadies today?

Rene and Christine are 42-year-old twins. They are currently in the middle of a career change and have decided to become entrepreneurs by buying a food franchise.

They are both in excellent health and only Rene is an average smoker.

In setting up the financial structure of their business, they each decided to take out a $400,000 10-year term life insurance policy, designating each other as irrevocable beneficiary.

What can we say about the premiums for the life insurance policies that will be issued?

Goran and Tanja married two years ago. Last year, they purchased and moved into a three-bedroom house in the suburbs. The current balance on their mortgage is $655,000. They meet with Ljubomir, an insurance agent, to purchase a joint term life insurance policy to cover the mortgage. When Ljubomir asks about their existing coverage, Goran shares that he has none. Tanja explains that she owns a universal life (UL) policy with a level death benefit of $50,000 and a cash surrender value (CSV) of $5,000, purchased 6 years ago from another agent. Tanja would like to surrender her UL policy and use the $5,000 CSV to pay for a trip to Europe. What additional information about Tanja's UL policy does Ljubomir need to collect?

A group of high school students visits Jacques, a financial security advisor, as part of Career Day. A student wants to know what an insurance contract is. What will Jacques answer?

A black and white math equation Description automatically generated with medium confidence

A black and white math equation Description automatically generated with medium confidence A number with numbers and lines Description automatically generated with medium confidence

A number with numbers and lines Description automatically generated with medium confidence