PEGACPDC25V1 Exam Dumps - Certified Pega Decisioning Consultant 25

Searching for workable clues to ace the Pegasystems PEGACPDC25V1 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s PEGACPDC25V1 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

A telecommunications company is promoting IPhone upgrades with unlimited data plans. The marketing team notices that a customer explicitly stated in a recent survey that they are not interested in iPhone products. The company wants to apply appropriate engagement policy conditions to respect customer preferences.

Which engagement policy condition type should you use to prevent iPhone offers for customers who express disinterest?

The development team at U+Bank wants to create multiple test personas for their new engagement strategy quickly. A team member suggests using Pega GenAI features instead of creating a manual persona to improve efficiency and speed up the testing process.

Which advantage does Pega GenAI provide when creating personas compared to manual creation?

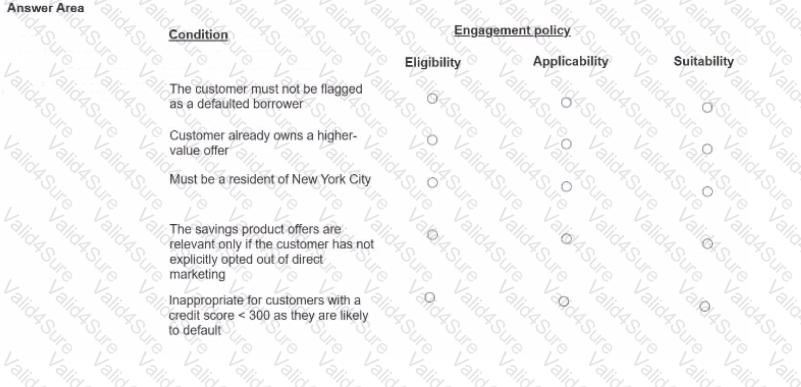

U+ Bank, a retail bank, has recently implemented a project in which credit card offers are presented to qualified customers when they log in to the web self-service portal The Dank added engagement policy conditions to show the offers based on the bank's requirements.

In the Answer Area, select the correct engagement policy for each condition.

Regional Bank has a fully implemented 1:1 customer engagement solution that is in the business-as-usual phase. A business user from this bank identifies the need for a new promotional offer for customers who regularly use mobile banking services. The user has detailed requirements including eligibility criteria, treatment messaging, and implementation timeline.

Which process should the business user follow to implement the new action?

Myco Bank, a retail bank, uses the Customer Engagement Blueprint to design personalized customer journeys. The bank wants to better understand its diverse customer base to create more targeted engagement strategies.

What key achievement does the Personas stage provide for Myco Bank when implementing with Customer Engagement Blueprint?

U+ Bank, a retail bank, introduced a new mortgage refinance offer in the eastern region of the country. They want to advertise this offer on their website by using a banner, targeting the customers who live in that area.

What do you configure in Next-Best-Action Designer to implement this requirement?