PEGACPDC25V1 Exam Dumps - Certified Pega Decisioning Consultant 25

Searching for workable clues to ace the Pegasystems PEGACPDC25V1 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s PEGACPDC25V1 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

U+Bank presents various credit card offers to Its customers on Its website. The bank uses AI to prioritize the offers according to customer behavior. After the introduction of the Gold credit card offer, the offer click-through propensity decreased to 0.42.

What does the decrease in the propensity value most likely indicate?

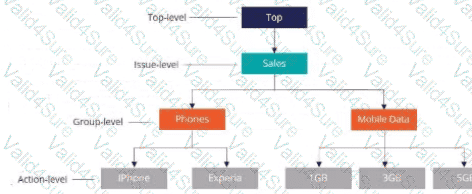

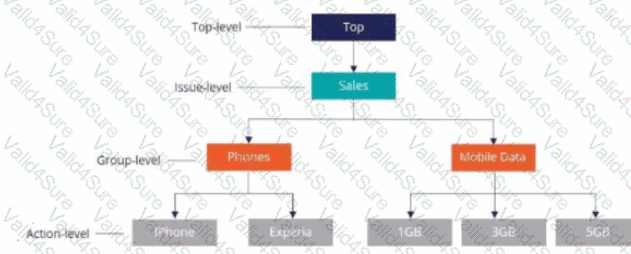

MyCo, a mobile company, uses Pega Customer Decision Hub'" to display offers to customers on its website. The company wants to present more relevant offers to customers based on customer behavior. The following diagram is the action hierarchy in the Next-Best-Action Designer.

The company wants to present offers from both the groups and arbitrate across the two groups to select the best offer based on customer behavior.

As a decisioning architect, what must you do to present offers from the two groups'

MyCo, a mobile company, uses Pega Customer Decision Hubâ„¢ to display offers to customers on its website. The company wants to present more relevant offers to customers based on customer behavior. The following diagram is the action hierarchy in the Next-Best-Action Designer.

The company wants to present offers from both the groups and arbitrate across the two groups to select the best offer based on customer behavior.

As a decisioning architect, what must you do to present offers from the two groups?

MegaRetail Solutions has successfully created and approved their brand voice in Pega 1:1 Operations Manager. They have also established global directives for style, grammar, language, and compliance. Now they want to ensure that their Pega GenAI system uses this brand voice to generate marketing treatments that also maintain consistency with their established guidelines.

How will MegaRetail Solutions' approved brand voice be applied in their content generation process?

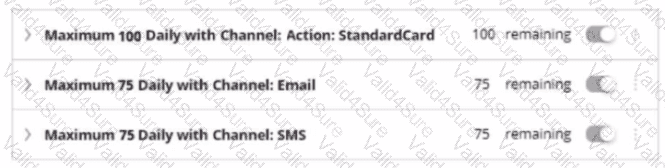

An outbound run identifies 150 Standard card offers, 75 on email, and 75 on the SMS channel. If the following volume constraint is applied, how many actions are delivered by the outbound run?

U+ Bank's marketing department currently promotes various home loan offers to qualified customers. Now, the bank does not want to show offers on a customer's account page if the customer has already received three home loan offers in the last two weeks.

What do you need to define to implement the business requirement?

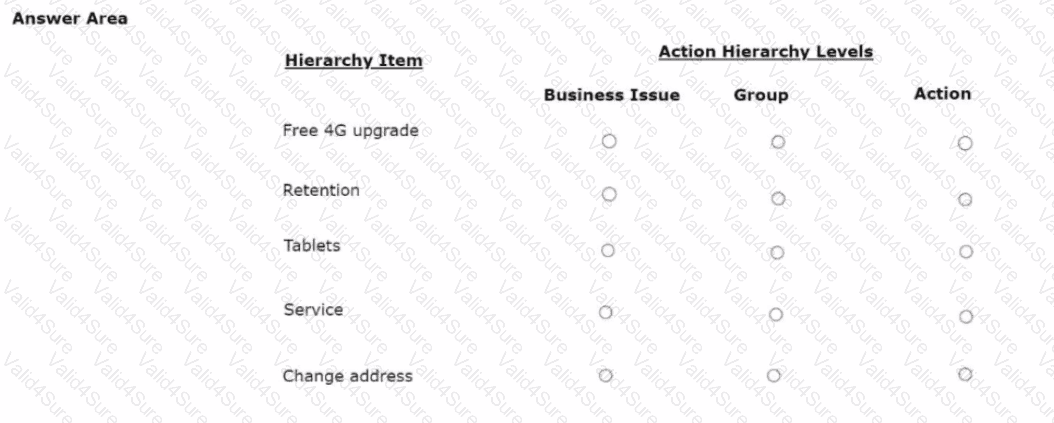

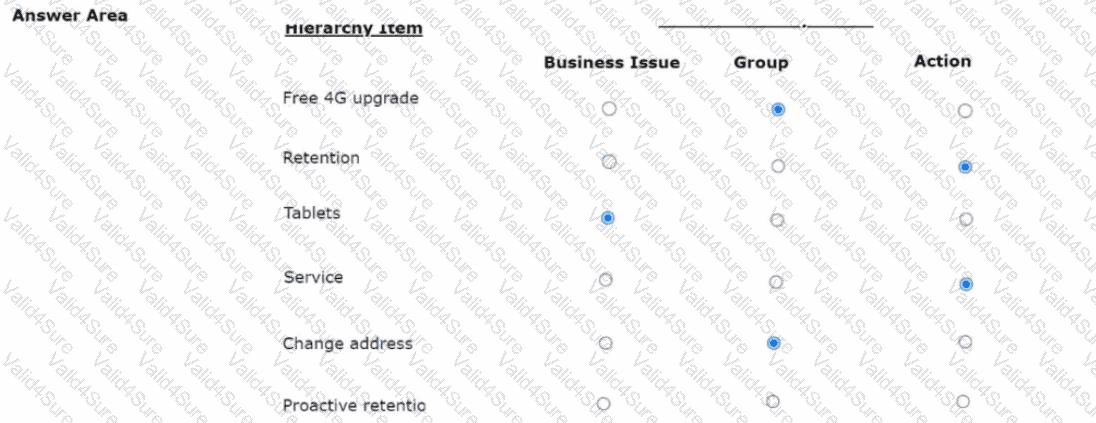

As a decisioning architect, you are setting up the action hierarchy for MyCo. Select the correct action hierarchy level for each of the hierarchy items identified.

A declsioning architect wants to use the customer properties Gender and MonthlyAverageUsage in a Data Join component. Which decision component is required to enable access to these properties?

A screenshot of a survey AI-generated content may be incorrect.

A screenshot of a survey AI-generated content may be incorrect.