PEGACPDC25V1 Exam Dumps - Certified Pega Decisioning Consultant 25

Searching for workable clues to ace the Pegasystems PEGACPDC25V1 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s PEGACPDC25V1 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

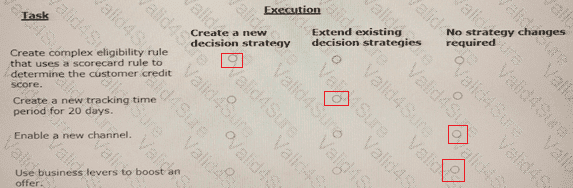

U+ Bank, a retail bank, presents offers on its website by using Pega Customer Decision Hubâ„¢. The bank wants to leverage Customer Decision Hub capabilities to present relevant offers to qualified customers. As a decisioning consultant, you are responsible for configuring the business requirements with the Next-Best-Action Designer, which involves several tasks. To accomplish these tasks, you might have to use auto-generated decision strategies, create new decision strategies, or edit existing strategies.

In the Answer Area, select the correct execution for each Task.

U+ Bank wants to use Pega Customer Decision Hubâ„¢ to show the Reward Card offer on its website to the qualified customers. In preparation, the action, the treatment, and the real-time container are already created. As a decisioning architect, you need to verify the configurations in the Channel tab of the Next-Best-Action Designer to enable the website to communicate with Pega Customer Decision Hub.

To achieve this requirement, which two tasks do you ensure are complete in the Channel tab of the Next-Best-Action Designer? (Choose Two)

The U+ Bank marketing department wants to leverage the next-best-action capability of Pega Customer Decision Hubâ„¢ on Its website to promote new offers to each customer.

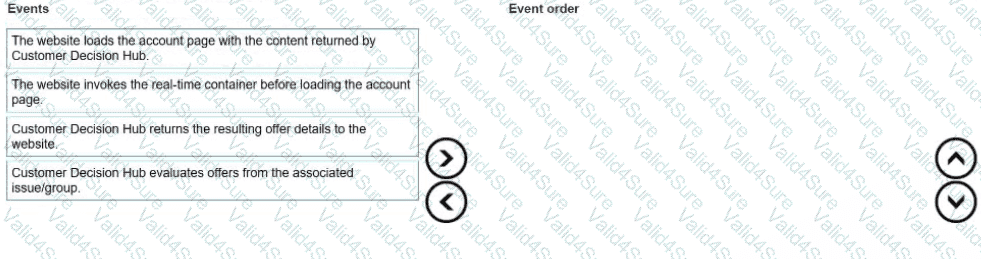

Place the events in the sequential order.

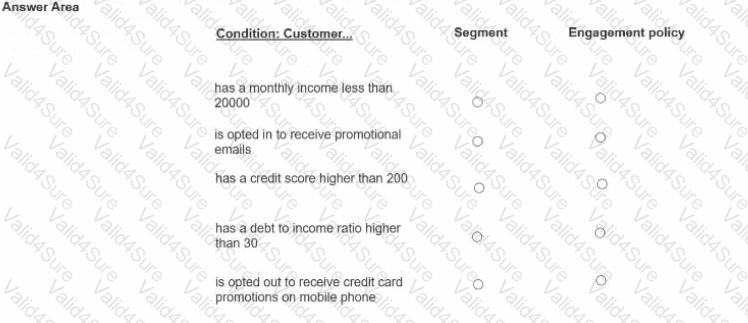

U+ Bank's marketing department wants to use the always-on outbound approach to send promotional emails about credit card offers to qualified customers. As a part of this promotion, the bank wantsto identify the starting population by defining a few high-level criteria ina segment.

For each condition below, select which two conditions should be defined in Segment and which three conditions should be defined in Engagement policy as best practice

MyCo, a mobile company, uses Pega Customer Decision Hubâ„¢ to display offers to customers on its website. The company wants to present more relevant offers to customers based on customer behavior. The following diagram is the action hierarchy in the Next-Best-Action Designer.

The company wants to present offers from both the groups and arbitrate across the two groups to select the best offer based on customer behavior.

The company wants to present offers from both the groups and arbitrate across the two groups to select the best offer based on customer behavior.

As a decisioning architect, what do you configure to select the best offer from both groups based on customer behavior?

MyCo, a telecom company, wants to use Pega Customer Decision Hubâ„¢ to send the MyFone Pro offer through email to qualified customers. In preparation, the marketing team created an action, a treatment, and an action flow. As a decisioning architect, you verify the settings in the Channel tab of Next-Best-Action Designer to enable email communication.

To implement this requirement, the completion of which two tasks do you verify in the Channel tab of Next-Best-Action Designer? (Choose Two)

A decisioning architect wants to use the customer properties income and age in a Filter component. Which decision component is required to enable access to these properties?

A screenshot of a computer screen Description automatically generated

A screenshot of a computer screen Description automatically generated