IFC Exam Dumps - Investment Funds in Canada (IFC) Exam

Searching for workable clues to ace the CSI IFC Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s IFC PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

Jenny contributed $5,000 each year for five years to a spousal RRSP in Albert's name. In the sixth calendar year, Jenny did not contribute and Albert withdrew all the funds from the spousal RRSP. What are the tax implications of the withdrawal for Albert and Jenny?

Justin and Yvonne both open a Registered Education Savings Plan (RESP) for their daughter Grace. They plan to regularly contribute $1,000 per year until Grace reaches the age of 17.

Which of the following statements relating to RESP is CORRECT?

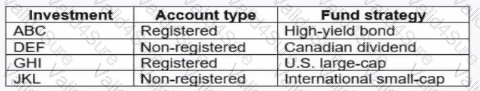

Matthew is planning on making the following investments in December:

Assuming all four investments have performed well throughout the year, which investment will trigger the highest unexpected taxes?

What is the national self-regulatory organization (SRO) for investment dealers?

A mutual fund sales representative receives a client’s purchase order for equity mutual funds and confirms that the order is appropriate based on the client’s recorded investment knowledge and risk tolerance. The client explains that she had inherited the funds from a family member. The client states her investment objective to be long term. The representative records this information and processes the order. What the representative doesn’t know is that the client has recently lost her job and is living on unemployment insurance. What step did the representative need to take in order to uphold her duty of care?

Jasmine received an inheritance from her grandmother of $10,000. She wants to invest her money wisely. She has seen in the news that a particular energy company is doing very well and has good prospects. She has also seen how volatile its share price has been in the last year. She knows the risks of the resource sector and wants to invest but is not comfortable with so much volatility. Which of the following mutual fund benefits would address her concern?

Saheed is a retiree who is considering splitting his pension income with his wife, Minu.

Which of the following outcomes may occur if he shares his pension benefits?

Which of the following characteristics about mortgage mutual funds is CORRECT?