IFC Exam Dumps - Investment Funds in Canada (IFC) Exam

Searching for workable clues to ace the CSI IFC Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s IFC PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

Which statement regarding the underwriting process and over-the-counter (OTC) markets is CORRECT?

Which index would investors use as a benchmark for doing research on the largest listed public companies in the US marketplace?

What is the maximum yearly CESG available to a family earning $150,000 annually?

What term applies to unemployment created by a new technology that eliminates the need for subway train drivers?

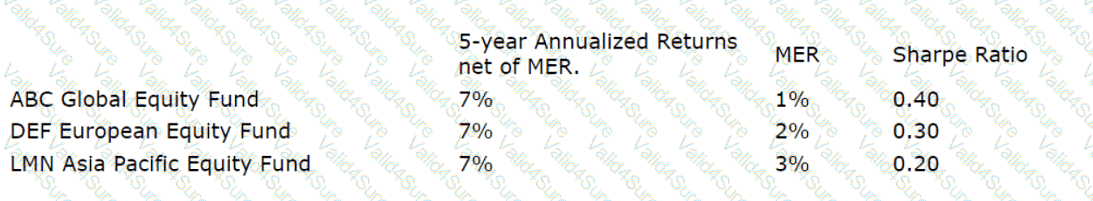

Danny is a Dealing Representative for Everbright Investments. He met with his client Adele, who has $1,000,000 to invest. During their meeting Danny determines that Adele has a high-risk profile. In addition, he learns that she has an excellent understanding of equities and how volatile they can be. Danny is considering recommending growth funds specifically, and making a recommendation from the following investment options:

Based on the information provided, which mutual fund should Danny recommend?