CTP Exam Dumps - Certified Treasury Professional

Searching for workable clues to ace the AFP CTP Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s CTP PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

Which of the following types of risk would an investor who does NOT receive payments on a security under the original terms be subject to?

All of the following are examples of treasury management system transactions for liquidity management EXCEPT:

The interest costs on commercial paper are determined by all of the following EXCEPT the:

An investor is interested in acquiring ownership in a firm while ensuring predictable timing and amount of cash flow. Which instrument should the investor choose?

A publicly-traded U.S. company has a German subsidiary which has accumulated significant cash balances. The company needs to pay its quarterly dividend but lacks the funds to make the payment. What is its BEST alternative for obtaining the funds?

Investors typically require a higher yield as compensation for holding securities that have:

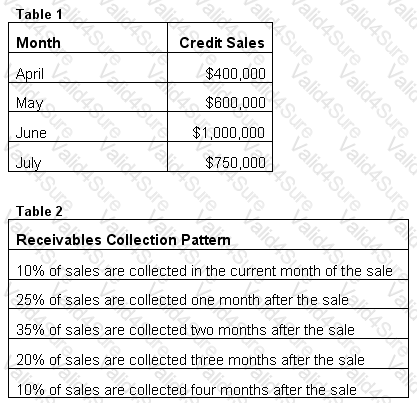

The company's monthly credit sales are in Table 1.

The company's receivables collection pattern is in Table 2. If this company's accounts receivable on March 31 is $0, what would the accounts receivable balance be at the end of July? Assume a 90-day quarter.