C11 Exam Dumps - Principles and Practice of Insurance

Searching for workable clues to ace the IIC C11 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s C11 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

What is the Canadian Insurance Claims Managers Association (CICMA) responsible for?

[Underwriting and Rating: Setting Insurance Rates]

If thenet premiumis $4,000 and thebroker’s commissionis 20%, what is thepolicy premium?

[Underwriting – Rates, Hazards, Perils]

What is the effect of perils and hazards on insurance rates for the underwriter?

[Insurance Documents and Processes]

What type of wording is written on a custom basis for a specific situation?

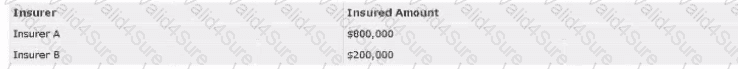

Insurer A and Insurer B cover the same building and the policies are NOT subject to contribution. The building sustains a loss of $450,000. How can the insured claim for their loss?

[Insurance Documents and Processes]

What should an insurer do if it wishes to have additional terms incorporated in an interim cover?

[Insurance as a Contract – Indemnity]

Kamal’s home has an actual cash value (ACV) of $380,000 and is insured for $400,000. The house suffers $180,000 damage. Which amount indemnifies Kamal?

A company suffers a $100,000 property loss at its commercial location. If Insurer X and Insurer Y have policies subject to the same terms and conditions, and there is no deductible, what will each insurer pay based on the information below?

Insurer X insured amount: $400,000

Insurer Y insured amount: $100,000