BUS105 Exam Dumps - Managerial Accounting (SAYA-0009) Exam

Searching for workable clues to ace the Saylor BUS105 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s BUS105 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

Thompson Dental is deciding between two lease options for a new copier. They anticipate making 22,500 copies spread evenly over the course of the year. Which of the following options should they choose if they want to save the most money on an annual basis, and how much money will they save?

Option 1: Monthly lease: $225, Included copies: 1,500/month, Additional copies: $0.15 per copy

Option 2: Monthly lease: $250, Included copies: 1,800/month, Additional copies: $0.02 per copy

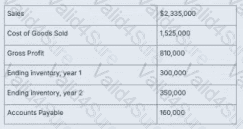

This is select financial statement data for Binks Corporation. What is the inventory turnover ratio for year 2?

You are the financial accountant for Antioch Ski Resort. Managers have been promised end-of-year bonuses if profits for the year increase by 10%. At the end of the year, you determine that profits increased by only 8%, and the managers ask you to "fudge the numbers a bit" so they can still receive their bonuses. What should you do?

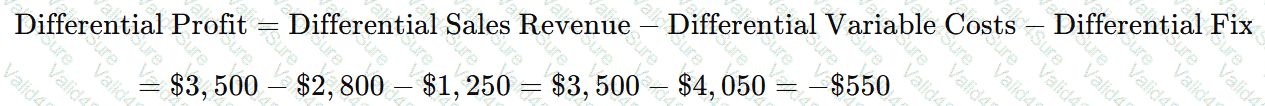

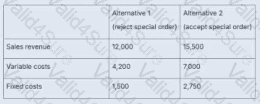

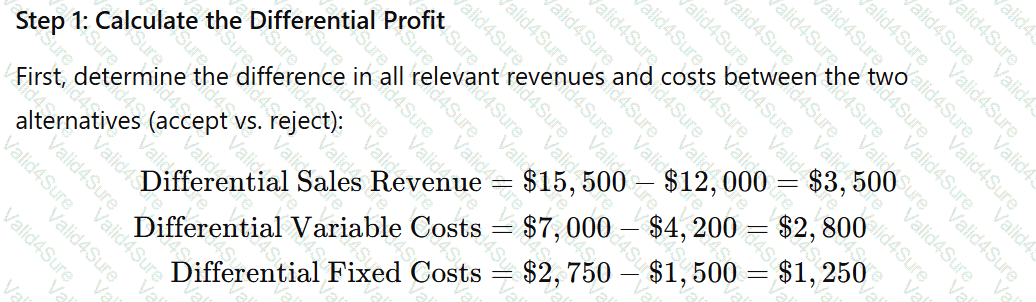

Cat Hats Inc. produces lines of headwear for cats. They have been asked by a local animal shelter to produce a special order for dogs. Below is a special order differential analysis prepared by their managerial accountant. Using this information, what would be the result of accepting the special order?

A close-up of a chart

AI-generated content may be incorrect.

A close-up of a chart

AI-generated content may be incorrect.