BUS105 Exam Dumps - Managerial Accounting (SAYA-0009) Exam

Searching for workable clues to ace the Saylor BUS105 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s BUS105 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

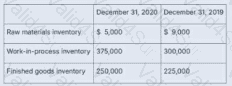

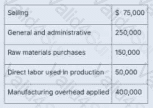

Archer Corporation manufactures coffee cups in the Midwest. Using this data, calculate the total current period manufacturing costs for the Schedule of Cost of Goods Manufactured for the year ending on December 31, 2021.

What are the total current period manufacturing costs for the Schedule of Cost of Goods Manufactured?

Bethel Bakery manufactures frosted sugar cookies. They maintain separate work-in-process accounts for their blending, cutting, baking, decorating, and packaging departments. Which costing method is Bethel Bakery most likely using?

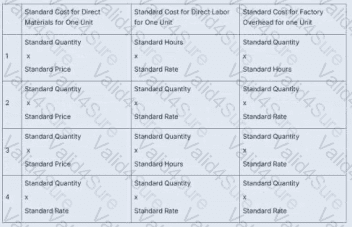

Which row correctly identifies the calculation to establish standard costs for direct materials, direct labor, and factory overhead?

Managers have several different methods from which to choose when evaluating long-term investments. Which method disregards the time value of money as a factor?

Cash collections and payments for purchases would be included in which of the following budgets as part of the overall master budget?

You are the newly hired manager of an individual restaurant chain. Which of the following responsibilities for your responsibility center would you be evaluated on?