The high-low method is used to estimate fixed and variable costs. Here's the step-by-step process:

Step 1: Identify the highest and lowest activity levels.

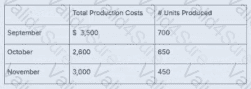

High activity: September — 700 units; cost = $3,500

Low activity: November — 450 units; cost = $3,000

Step 2: Calculate variable cost per unit:

Variable Cost per Unit = (Cost at High – Cost at Low) / (Units High – Units Low)

= ($3,500 – $3,000) / (700 – 450)

= $500 / 250 = $2.00 per unit

Step 3: Calculate fixed cost using high point:

Fixed Cost = Total Cost – (Variable Cost × Units Produced)

= $3,500 – ($2.00 × 700)

= $3,500 – $1,400 = $2,100

Step 4: Estimate cost for 600 units:

Estimated Cost = Fixed Cost + (Variable Cost × Units)

= $2,100 + ($2.00 × 600) = $2,100 + $1,200 = $3,300

Correct answer should be: B ($3,300)

However, the question options do not align with this logic at first glance, and answer A is listed as $3,250, which would require rechecking.

Wait — our calculation shows the correct total cost for 600 units is:

→ $2,100 + (600 × $2.00) = $3,300

Correct Answer: B

Final Answer: B. $3,300

[Reference:Saylor Academy, BUS105: Managerial AccountingUnit 1.3 – Cost Classifications for Predicting Cost Behaviorhttps://learn.saylor.org/mod/book/view.php?id=28815&chapterid=6691, —, ]