- Home

- CIPS

- CIPS Level 5 Advanced Diploma in Procurement and Supply

- L5M4 - Advanced Contract & Financial Management

L5M4 Exam Dumps - Advanced Contract & Financial Management

Searching for workable clues to ace the CIPS L5M4 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s L5M4 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

John is looking at the potential of three different projects and is considering the Return on Investment. What is meant by this, and what are the benefits and disadvantages of using this method? Which option should he choose? (25 marks)

Answer:

Explanation:

Part 1: What is meant by Return on Investment (ROI)? (8 marks)

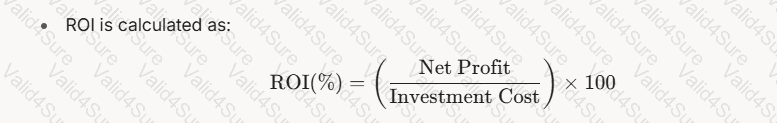

Return on Investment (ROI) is a financial metric used to evaluate the efficiency or profitability of an investment by measuring the return generated relative to its cost. In the context of the CIPS L5M4 Advanced Contract and Financial Management study guide, ROI is a key tool for assessingthe financial viability of projects or contracts, ensuring they deliver value for money. Below is a step-by-step explanation:

Definition:

A math equation with numbers and a square

AI-generated content may be incorrect.

A math equation with numbers and a square

AI-generated content may be incorrect.

Net Profit = Total Returns – Investment Cost.

Purpose:

It helps decision-makers like John compare the financial benefits of projects against their costs.

Example: A project costing £100k that generates £120k in returns has an ROI of 20%.

Part 2: Benefits and Disadvantages of Using ROI (10 marks)

Benefits:

Simplicity and Clarity:

ROI is easy to calculate and understand, providing a straightforward percentage to compare options.

Example: John can quickly see which project yields the highest return.

Focus on Financial Efficiency:

It aligns with L5M4’s emphasis on value for money by highlighting projects that maximize returns.

Example: A higher ROI indicates better use of financial resources.

Comparability:

Allows comparison across different projects or investments, regardless of scale.

Example: John can compare projects with different investment amounts.

Disadvantages:

Ignores Time Value of Money:

ROI does not account for when returns are received, which can skew long-term project evaluations.

Example: A project with returns in Year 3 may be less valuable than one with returns in Year 1.

Excludes Non-Financial Factors:

It overlooks qualitative benefits like quality improvements or strategic alignment.

Example: A project with a lower ROI might offer sustainability benefits.

Potential for Misleading Results:

ROI can be manipulated by adjusting cost or profit definitions, leading to inaccurate comparisons.

Example: Excluding hidden costs (e.g., maintenance) inflates ROI.

Part 3: Which Option Should John Choose? (7 marks)

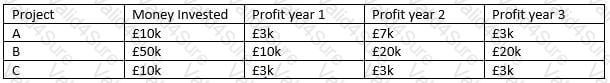

Using the data provided for the three projects, let’s calculate the ROI for each to determine the best option for John. The table is as follows:

A screenshot of a phone

AI-generated content may be incorrect.

A screenshot of a phone

AI-generated content may be incorrect.

Step 1: Calculate Total Profit for Each Project:

Project A: £3k (Year 1) + £3k (Year 2) + £3k (Year 3) = £9k

Project B: £3k (Year 1) + £3k (Year 2) + £3k (Year 3) = £9k

Project C: £3k (Year 1) + £3k (Year 2) + £3k (Year 3) = £9k

Step 2: Calculate Net Profit (Total Profit – Investment):

Project A: £9k – £10k = -£1k (a loss)

Project B: £9k – £50k = -£41k (a loss)

Project C: £9k – £10k = -£1k (a loss)

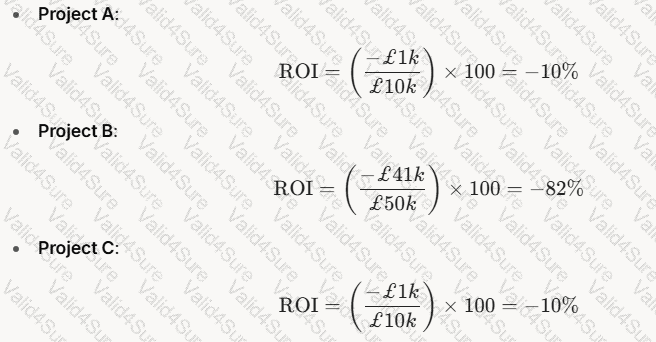

Step 3: Calculate ROI for Each Project:

A group of math equations

AI-generated content may be incorrect.

A group of math equations

AI-generated content may be incorrect.

Step 4: Compare and Choose:

Project A: -10% ROI

Project B: -82% ROI

Project C: -10% ROIAll projects show a negative ROI, meaning none generate a profit over the investment cost. However, Projects A and C have the least negative ROI at -10%, while Project B is significantly worse at -82%. Between A and C, the ROI is identical, but both require the same investment (£10k) and yield the same returns. Therefore, there is no financial difference between A and C based on ROI alone. However, since the question asks for a choice, John should choose eitherProject A or Project Cover Project B, as they minimize losses. Without additional qualitative factors (e.g., strategic fit, risk), either A or C is equally viable. For simplicity, let’s recommendProject A.

Recommendation: John should chooseProject A(or C), as it has a less negative ROI (-10%) compared to Project B (-82%), indicating a smaller financial loss.

Exact Extract Explanation:

Part 1: What is Return on Investment?

The CIPS L5M4 Advanced Contract and Financial Management study guide explicitly covers ROI in the context of financial management tools for evaluating contract or project performance. It defines ROI as "a measure of the gain or loss generated on an investment relative to the amount invested," typically expressed as a percentage. The guide positions ROI as a fundamental metric for assessing "value for money," a core principle of L5M4, especially when selecting projects or suppliers.

Detailed Explanation:

The guide explains that ROI is widely used because it provides a "clear financial snapshot" of investment performance. In John’s case, ROI helps compare the profitability of three projects.

It also notes that ROI is often used in contract management to evaluate supplier performance or project outcomes, ensuring resources are allocated efficiently.

Part 2: Benefits and Disadvantages

The study guide discusses ROI’s role in financial decision-making, highlighting its strengths and limitations, particularly in contract and project evaluations.

Benefits:

Simplicity and Clarity:

Chapter 4 notes that ROI’s "ease of calculation" makes it accessible for quick assessments, ideal for John’s scenario.

Focus on Financial Efficiency:

The guide emphasizes ROI’s alignment with "maximizing returns," ensuring investments like John’s projects deliver financial value.

Comparability:

ROI’s percentage format allows "cross-project comparisons," per the guide, enabling John to evaluate projects with different investment levels.

Disadvantages:

Ignores Time Value of Money:

The guide warns that ROI "does not consider the timing of cash flows," a critical limitation. For John, returns in Year 3 are less valuable than in Year 1 due to inflation or opportunity costs.

Excludes Non-Financial Factors:

L5M4 stresses that financial metrics alone can miss "strategic benefits" like quality or innovation, which might apply to John’s projects.

Potential for Misleading Results:

The guide cautions that ROI can be "distorted" if costs or profits are misreported, a risk John should consider if project data is incomplete.

Part 3: Which Option Should John Choose?

The guide’s focus on ROI as a decision-making tool directly supports the calculation process above. It advises using ROI to "rank investment options" but also to consider broader factors if results are close, as seen with Projects A and C.

Analysis:

The negative ROIs indicate all projects are unprofitable, a scenario the guide acknowledges can occur, suggesting further analysis (e.g., risk, strategic fit). However, based solely on ROI, A and C are better than B.

The guide’s emphasis on minimizing financial loss in poor-performing investments supports choosing A or C, as they have the least negative impact.

Outline three methods an organization could use to gain feedback from stakeholders (25 points)

Answer:

Explanation:

Gaining feedback from stakeholders helps organizations understand their needs and improve performance. Below are three methods, detailed step-by-step:

Surveys and Questionnaires

Step 1: Design the ToolCreate structured questions (e.g., Likert scales, open-ended) tailored to stakeholder groups like customers or suppliers.

Step 2: DistributionDistribute via email, online platforms, or in-person to ensure accessibility.

Step 3: AnalysisCollect and analyze responses to identify trends or issues (e.g., supplier satisfaction with payment terms).

Outcome:Provides quantitative and qualitative insights efficiently.

Focus Groups

Step 1: Organize the SessionInvite a small, diverse group of stakeholders (e.g., employees, clients) for a facilitated discussion.

Step 2: Conduct the DiscussionUse open-ended questions to explore perceptions (e.g., “How can we improve delivery times?â€).

Step 3: Record and InterpretSummarize findings to capture detailed, nuanced feedback.

Outcome:Offers in-depth understanding of stakeholder views.

One-on-One Interviews

Step 1: Select ParticipantsChoose key stakeholders (e.g., major suppliers, senior staff) for personalized engagement.

Step 2: Conduct InterviewsAsk targeted questions in a private setting to encourage candid responses.

Step 3: Synthesize FeedbackCompile insights to address specific concerns or opportunities.

Outcome:Builds trust and gathers detailed, individual perspectives.

Exact Extract Explanation:

The CIPS L5M4 Study Guide highlights stakeholder feedback methods:

Surveys:"Surveys provide a scalable way to gather structured feedback from diverse stakeholders" (CIPS L5M4 Study Guide, Chapter 1, Section 1.8).

Focus Groups:"Focus groups enable qualitative exploration of stakeholder opinions" (CIPS L5M4 Study Guide, Chapter 1, Section 1.8).

Interviews:"One-on-one interviews offer detailed, personal insights, fostering stronger relationships" (CIPS L5M4 Study Guide, Chapter 1, Section 1.8).These methods enhance stakeholder engagement in procurement and financial decisions. References: CIPS L5M4 Study Guide, Chapter 1: Organizational Objectives and Financial Management.

Discuss ways in which an organization can improve their short-term cash flow (25 points)

Answer:

Explanation:

Improving short-term cash flow involves strategies to increase cash inflows and reduce outflows within a short timeframe. Below are three effective methods, explained step-by-step:

Accelerating Receivables Collection

Step 1: Tighten Credit TermsShorten payment terms (e.g., from 60 to 30 days) or require deposits upfront.

Step 2: Incentivize Early PaymentsOffer discounts (e.g., 1-2% off) for payments made before the due date.

Step 3: Automate ProcessesUse electronic invoicing and reminders to speed up debtor responses.

Impact on Cash Flow:Increases immediate cash inflows by reducing the time money is tied up in receivables.

Delaying Payables Without Penalties

Step 1: Negotiate TermsExtend payment terms with suppliers (e.g., from 30 to 60 days) without incurring late fees.

Step 2: Prioritize PaymentsPay critical suppliers first while delaying non-urgent ones within agreed terms.

Step 3: Maintain RelationshipsCommunicate transparently with suppliers to preserve goodwill.

Impact on Cash Flow:Retains cash longer, improving short-term liquidity.

Selling Surplus Assets

Step 1: Identify AssetsReview inventory, equipment, or property for underutilized or obsolete items.

Step 2: Liquidate QuicklySell via auctions, online platforms, or trade buyers to convert assets to cash.

Step 3: Reinvest ProceedsUse funds to meet immediate cash needs or reduce short-term borrowing.

Impact on Cash Flow:Provides a quick influx of cash without relying on external financing.

Exact Extract Explanation:

The CIPS L5M4 Study Guide emphasizes practical techniques for short-term cash flow management:

Receivables Collection:"Accelerating cash inflows through tighter credit policies and incentives is a primary method for improving liquidity" (CIPS L5M4 Study Guide, Chapter 3, Section 3.2).

Delaying Payables:"Extending supplier payment terms, where possible, preserves cash for operational needs" (CIPS L5M4 Study Guide, Chapter 3, Section 3.5), though it advises maintaining supplier trust.

Asset Sales:"Liquidating surplus assets can provide an immediate cash boost in times of need" (CIPS L5M4 Study Guide, Chapter 3, Section 3.6), particularly for organizations with excess resources.These approaches are critical for procurement professionals to ensure financial agility. References: CIPS L5M4 Study Guide, Chapter 3: Financial Management Techniques.

What are three financial risks in exchange rate changes and how might an organization overcome these? (25 points)

Answer:

Explanation:

Exchange rate changes pose financial risks to organizations engaged in international trade. Below are three risks and mitigation strategies, explained step-by-step:

Transaction Risk

Step 1: Define the RiskLoss from exchange rate fluctuations between invoicing and payment (e.g., a stronger supplier currency increases costs).

Step 2: MitigationUse forward contracts to lock in rates at the time of contract agreement.

Step 3: OutcomeEnsures predictable costs, avoiding cash flow disruptions.

Translation Risk

Step 1: Define the RiskImpact on financial statements when converting foreign subsidiary earnings to the home currency (e.g., weaker foreign currency reduces reported profits).

Step 2: MitigationHedge via currency swaps or maintain natural hedges (e.g., matching foreign assets and liabilities).

Step 3: OutcomeStabilizes reported earnings, aiding financial planning.

Economic Risk

Step 1: Define the RiskLong-term currency shifts affecting competitiveness (e.g., a stronger home currency makes exports pricier).

Step 2: MitigationDiversify operations or sourcing across countries to spread exposure.

Step 3: OutcomeReduces reliance on any single currency’s performance.

Exact Extract Explanation:

The CIPS L5M4 Study Guide identifies these risks and solutions:

Transaction Risk:"Arises from timing differences in international payments, mitigated by forwards" (CIPS L5M4 Study Guide, Chapter 5, Section 5.1).

Translation Risk:"Affects consolidated accounts and can be managed through hedging or balance sheet strategies" (CIPS L5M4 Study Guide, Chapter 5, Section 5.1).

Economic Risk:"Long-term exposure requires strategic diversification" (CIPS L5M4 Study Guide, Chapter 5, Section 5.1).These align with managing FX volatility in procurement. References: CIPS L5M4 Study Guide, Chapter 5: Managing Foreign Exchange Risks.===========

Discuss the different financial objectives of the following organization types: public sector, private sector, charity sector (25 points)

Answer:

Explanation:

The financial objectives of organizations vary significantly depending on their type—public sector, private sector, or charity sector. Below is a detailed step-by-step explanation of the financial objectives for each:

Public Sector Organizations

Step 1: Understand the PurposePublic sector organizations are government-owned or controlled entities focused on delivering public services rather than generating profit.

Step 2: Identify Financial Objectives

Value for Money (VfM):Ensuring efficient use of taxpayer funds by balancing economy, efficiency, and effectiveness.

Budget Compliance:Operating within allocated budgets set by government policies.

Service Delivery:Prioritizing funds to meet public needs (e.g., healthcare, education) rather than profit.

Cost Control:Minimizing waste and ensuring transparency in financial management.

Private Sector Organizations

Step 1: Understand the PurposePrivate sector organizations are privately owned businesses aiming to generate profit for owners or shareholders.

Step 2: Identify Financial Objectives

Profit Maximization:Achieving the highest possible financial returns.

Shareholder Value:Increasing share prices or dividends for investors.

Revenue Growth:Expanding sales and market share to boost income.

Cost Efficiency:Reducing operational costs to improve profit margins.

Charity Sector Organizations

Step 1: Understand the PurposeCharities are non-profit entities focused on social, environmental, or humanitarian goals rather than profit.

Step 2: Identify Financial Objectives

Fundraising Efficiency:Maximizing income from donations, grants, or events.

Cost Management:Keeping administrative costs low to direct funds to the cause.

Sustainability:Ensuring long-term financial stability to continue operations.

Transparency:Demonstrating accountability to donors and stakeholders.

Exact Extract Explanation:

The CIPS L5M4 Advanced Contract and Financial Management study guide emphasizes understanding organizational objectives as a foundation for effective financial and contract management. According to the guide:

Public Sector:The focus is on "delivering value for money and achieving social outcomes rather than profit" (CIPS L5M4 Study Guide, Chapter 1, Section 1.2). This includesadhering to strict budgetary controls and public accountability standards.

Private Sector:The guide highlights that "private sector organizations prioritize profit maximization and shareholder wealth" (CIPS L5M4 Study Guide, Chapter 1, Section 1.3). Financial strategies are aligned with competitive market performance and cost efficiencies.

Charity Sector:Charities aim to "maximize the impact of funds raised while maintaining financial sustainability" (CIPS L5M4 Study Guide, Chapter 1, Section 1.4). This involves balancing fundraising efforts with low overheads and compliance with regulatory requirements.These distinctions are critical for procurement professionals to align contract strategies with organizational goals. References: CIPS L5M4 Study Guide, Chapter 1: Organizational Objectives and Financial Management.