FPC-Remote Exam Dumps - Fundamental Payroll Certification

Searching for workable clues to ace the APA FPC-Remote Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s FPC-Remote PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

To identify an out-of-balance general ledger account, all of the following documents should be used EXCEPT:

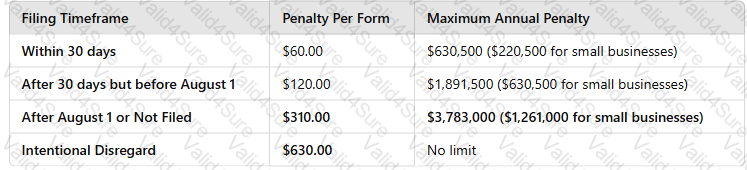

When an information return is filed after August 1st of the same year, the penalty amount per form is:

An employee receives a total of $200.10 in cash tips in July. Determine the latest date the employee MUST report tip income to the employer.

A company has engaged an individual to write a sales contract. The individual receives a flat amount for the task and has an assigned time frame for completion. This individual is classified as a(n):

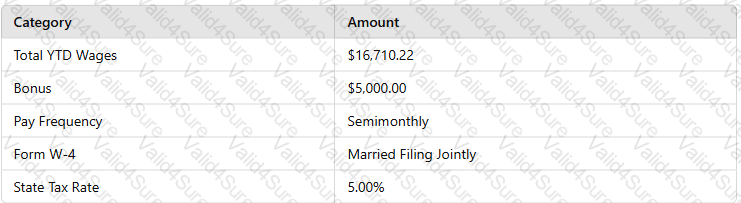

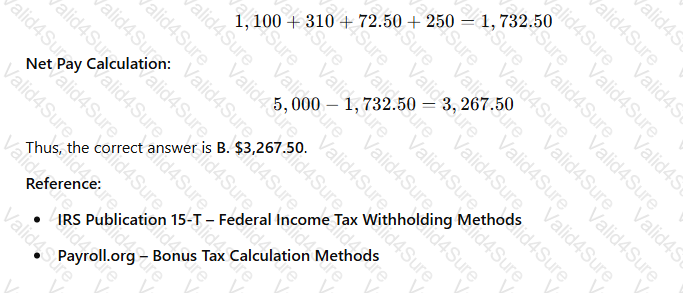

An exempt employee is being paid an annual discretionary bonus. The employee has submitted a 2020 W-4. Calculate the net pay based on the following information:

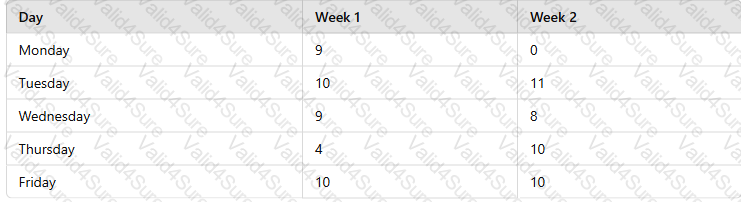

A non-exempt hospital employee works a 14-day period at $14.00 per hour under the 8/80 rule. The employee worked the following hours during the two-week period:

Calculate the employee's biweekly gross pay.

Which of the following statements is TRUE regarding the pre-notification process?

A screenshot of a computer screen

AI-generated content may be incorrect.

A screenshot of a computer screen

AI-generated content may be incorrect. A white paper with black text

AI-generated content may be incorrect.

A white paper with black text

AI-generated content may be incorrect.