Financial-Management Exam Dumps - WGU Financial Management VBC1

Searching for workable clues to ace the WGU Financial-Management Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s Financial-Management PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

Why might tax expense on the income statement not reflect the actual taxes paid by a firm?

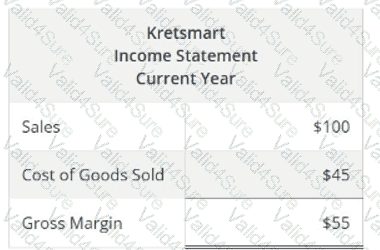

Kretsmart anticipates its sales will grow by10% each year for the next two years. Information from the company’s current income statement is given below, andCost of Goods Sold (COGS) is assumed to be a spontaneous account.

What would the company’sprojected gross margin for Year 2?

What is the relationship between the length of the cash cycle and the amount of cash a firm needs to operate?

In the statement of cash flows, what is the most commonly used method by financial analysts to calculate cash flows from operations (CFO)?

How does the global bond market impact the strategies of multinational corporations?

Rusty RoboTech, a robotics technology company, has provided the following financial information for the year 20X3:

• Sales Revenue: $500,000

• Net Income: $50,000

• Dividend Payout: 40% of Net Income

• Total Assets at the beginning of 20X3: $300,000

• Total Liabilities at the beginning of 20X3: $150,000

• Equity at the beginning of 20X3: $150,000

• Historical Cash-to-Sales Ratio: 5%

• Accounts Receivable-to-Sales Ratio: 15%

• Inventory-to-Sales Ratio: 25%

• Cost of Goods Sold-to-Sales Ratio: 43%

For the year 20X4, Rusty RoboTech projects a 20% increase in sales revenue. Other ratios and the dividend policy are expected to remain the same.

What is the projected inventory value for Rusty RoboTech at the beginning of 20X4?