CTEP Exam Dumps - Chartered Trust & Estate Planner® (CTEP®) Certification Examination

Searching for workable clues to ace the AAFM CTEP Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s CTEP PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

In US for year 2013, Grandparent care giver relief is ___________ and Course fee relief is __________.

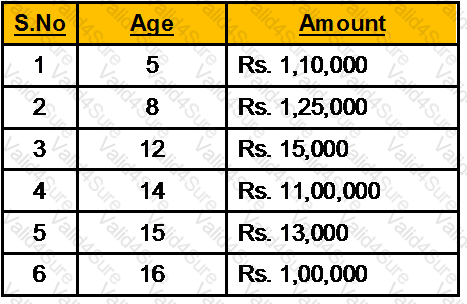

Mr. Shikar wants to invest his savings in an account that pays an interest rate of 9.25% p.a. compounded annually at different ages of his son whose current age is 4 years. Please calculate for him the Future Value of these investments when his son turns 18.

For tax year 2013, AMT rate is _______ up to $175,000 of Alternative Minimum Taxable Income (AMTI).

The Hindu Succession (Amendment Act),2005 amended ____________ of the Hindu Succession Act,1956 allowing daughters of the deceased equal rights with the sons.

In case of __________ trust there is no Inheritance Tax if the settlor survives for _________ years.

Which of the following device(s) may prove useful in reducing the tax incidence in the case of HUF?