CTEP Exam Dumps - Chartered Trust & Estate Planner® (CTEP®) Certification Examination

Searching for workable clues to ace the AAFM CTEP Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s CTEP PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

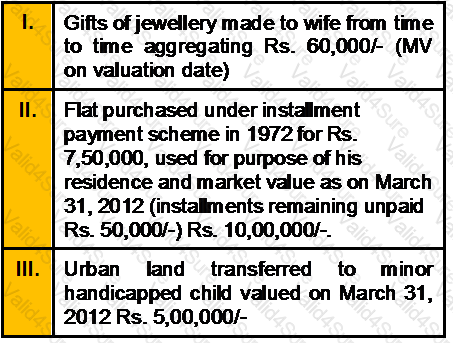

X furnishes the following particulars for the compilation of his wealth-tax return for assessment year 2012-13.

Calculate the amount on which Wealth Tax is Payable.

Tax rate on foreign sourced income in Singapore is ____ to _______ subject to conditions.

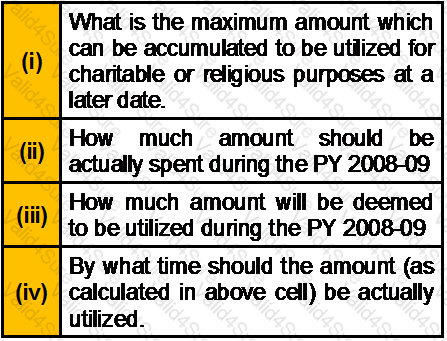

During the PY 2008-09 a charitable trust earned an income of Rs. 5 lakh out of which Rs. 3 lakh was received during the PY 2008-09 and the balance Rs. 2 lakh was received during the PY 2010-2011.To claim full exemption of Rs. 5 lakh in the PY 2008-09, state:

Under the provisions of _________of the Hindu Succession Act, 1956 where a Hindu male dies intestate on or after __________, having at the time of his death an interest in a Mitakshara coparcenary property leaving behind a female heir of the Class I category, then his interest in the coparcenary property shall devolve by succession under that Act and not by survivorship.

Under ___________ of Income Tax Act,1961, partial partitions will not be recognized for tax purposes.