BA3 Exam Dumps - Fundamentals of financial accounting

Searching for workable clues to ace the CIMA BA3 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s BA3 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

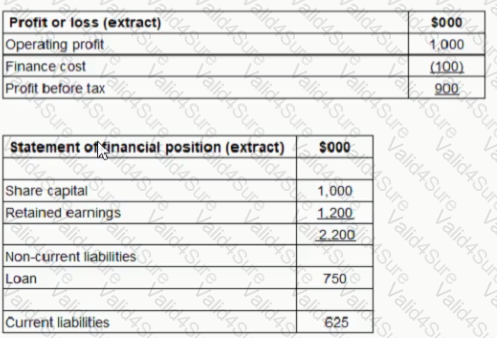

The following are extracts from CD's financial statements for the year to 31 December 20X2:

What is the return on capital employed percentage (ROCE) for CD for the year ended 31 December 20X2?

Refer to the Exhibit.

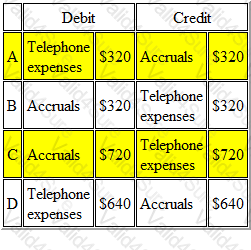

A company is preparing its accounts to 30 April 2006. The latest telephone bill received by the company was dated 31 March and included call charges for the quarter 1 December to 28 February. The amount of the bill for call charges (excluding VAT) was $960. Most of the company's telephone bills are for similar amounts.

Which of the following journal entries should be made to the company's accounts at 30 April 2006?

The journal entries which should be made to the company's accounts at 30 April 2006 is

On 1 January 2001, a company owed a supplier £840.

During the month of January the company purchased goods for £1400 and returned goods valued at £200. A payment of £200 was made towards the outstanding balance. The supplier offered a discount of 5% on purchases.

The balance on the supplier's account at the end of the period is:

Company X is a private limited oil company. Which of the following are relevant for Company X's integrated report?