PEGACPDC88V1 Exam Dumps - Certified Pega Decisioning Consultant 8.8 V1

Searching for workable clues to ace the Pegasystems PEGACPDC88V1 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s PEGACPDC88V1 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

U+ Bank has recently implemented Pega Customer Decision Hubâ„¢. As a first step, the bank went live with the contact center to improve customer engagement. Now, U+ Bank wants to extend its customer engagement through the web channel. As a decisioning architect, you have created the new set of actions, the corresponding treatments, and defined a new trigger in the Next-Best-Action Designer for the new web channel.

What else do you configure for the new treatments to be present in the next-best-action recommendations?

U+ Bank follows all engagement policy best practices to present credit card offers on their website. The bank has introduced a new credit card offer, the Rewards card. Anna, an existing customer, currently holds a higher value card, Premier Rewards, and does not see the new Rewards card offer.

What condition possibly prevents Anna from seeing the new Rewards card offer?

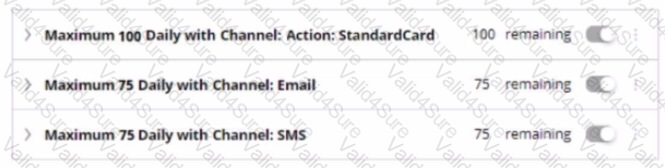

U+ Bank has recently defined two contact policies:

1. Suppress a group of credit card offers for 30 days if any credit card offer is rejected three times in any channel in the past 15 days.

2. Suppress the Reward card offer, part of the credit card group, for 7 days if it is rejected twice in any channel in the last 7 days. Paul, an existing U+ Bank customer, no longer sees the Reward card offer. What is the reason that Paul cannot see the offer?

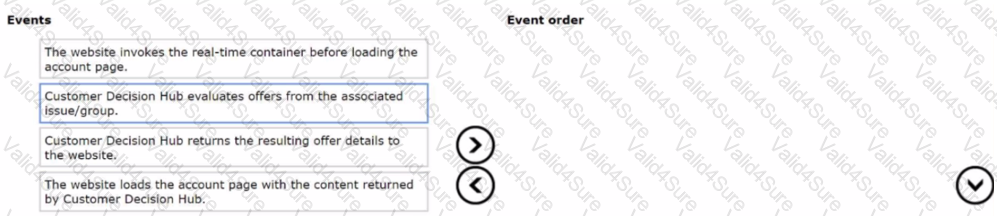

The U+ Bank marketing department wants to leverage the next-best-action capability of Pega Customer Decision Hubâ„¢ on its website to promote new offers to each customer.

Place the events in the sequential order.

An outbound run identifies 150 Standard card offers, 75 on email, and 75 on the SMS channel. If the following volume constraint is applied, how many actions are delivered by the outbound run?