GAFRB Exam Dumps - Examination 2: Governmental Accounting, Financial Reporting and Budgeting (GAFRB)

Searching for workable clues to ace the AGA GAFRB Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s GAFRB PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

A county is projecting a $7 million budget deficit in the upcoming fiscal year, so the county board, who acts as the highest level of authority for the county, sets aside $7 million in fund balance to close this gap. How should the $7 million be classified on the financial statement?

What fund category traditionally accounts for the general services to the public such as public safety, health, transportation, social services and the administration of the government?

The legal congressional permission for an executive branch department or agency to enter into an obligation that will result in an immediate or future outlay is referred to as

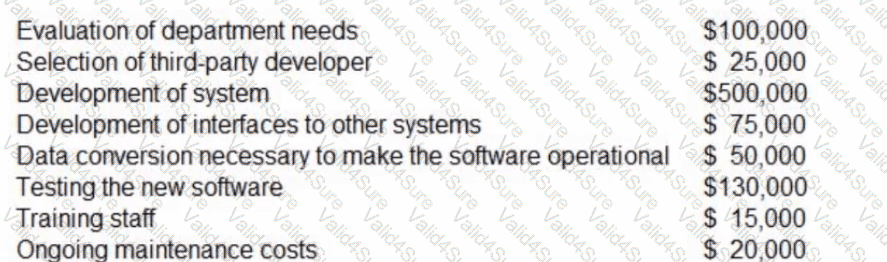

A state department has been developing a new computer system for managing federal grants. The project has the following costs:

What amount should be recorded as the value of the intangible asset?