F2 Exam Dumps - F2 Advanced Financial Reporting

Searching for workable clues to ace the CIMA F2 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s F2 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

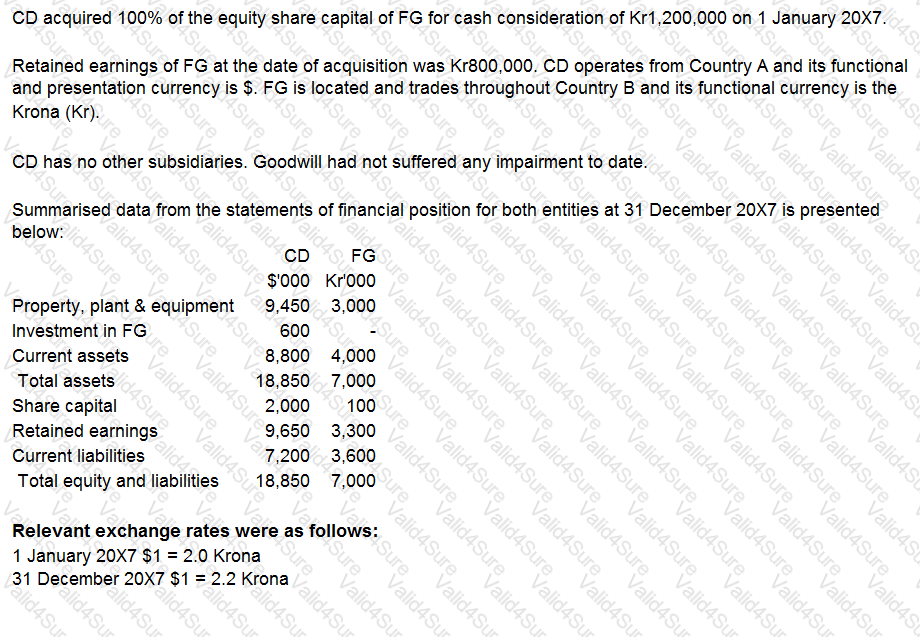

Calculate the exchange difference arising on the retranslation of goodwill on the acquisition in the consolidated statement of financial position of CD at 31 December 20X7.

Give your answer to the nearest $000.

$Â ? 000

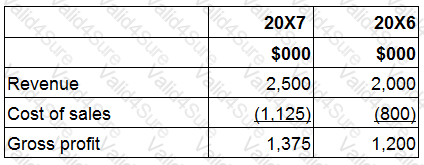

KL sells luxury leather handbags and has 3 stores in exclusive shopping areas. Following years of static revenues and margins, in August 20X6Â KLÂ opened a fourth store at a busy airport terminal which is proving to be successful.

The revenue and gross profit of KL for the years ended 31 March 20X7 and 20X6 are as follows:

Which of the following would be a contributing factor to the movement in the gross profit margin of KL?

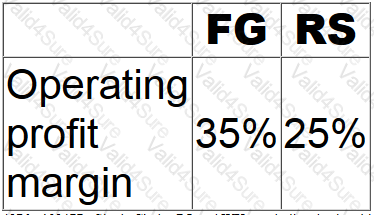

FG and RS operate in the same retail sector within the same country and are of a similar size. The following ratios have been calculated based on the financial statements for the year ended 30 September 20X4:

Which of the following factors would limit the usefulness of these ratios as a basis for assessing the comparative performances of FG and RS?

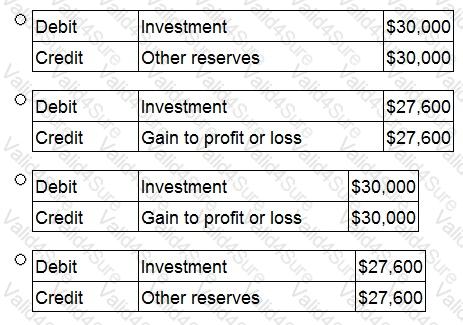

On 1 September 20X3, GH purchased 200,000 $1 equity shares in QR for $1.20 each and classified this investment as held for trading.

GH paid a 1% transaction fee to its broker on this transaction. QR's equity shares had a fair value of $1.35 each on 31 December 20X3.

Which of the following journals records the subsequent measurement of this financial instrument at 31 December 20X3?

The IAS definitions of financial instruments dictate their classification between debt and equity. Which of of the following factors might this classification impact?

Select ALL that apply.