F1 Exam Dumps - Financial Reporting

Searching for workable clues to ace the CIMA F1 Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s F1 PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

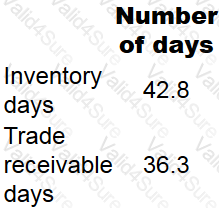

AAA has the following working capital ratios at 30 March 20X4:

During the year ended 30 March 20X4 credit purchases were $3,600 and at 30 March 20X4 the outstanding trade payables amounted to $522.

The year ended 30 March 20X4 was not a leap year.

Calculate the working capital cycle for AAA.

Give your answer to one decimal place.

When developing local Generally Accepted Accounting Principles (known as local GAAP) some countries start with International Financial Reporting Standards (IFRSs) which are then amended to reflect local needs and conditions.

This type of approach is classified as:

QR purchased a property for its investment potential on 1 January 20X3 for $2.5 million.

The total property cost is split as follows: land $1 million and buildings $1.5 million. The buildings were expected to have a remaining useful life of 40 years.

The local property index at 31 December 20X3 indicates that the fair value of the property has risen by 10%.

What is the balance that QR will include in its statement of financial position at 31 December 20X3 for this property, assuming that it uses the IAS 40 Investment Properties fair value model?

Give your answer in $million to two decimal places.

Why are excise duties an attractive method of raising tax for governments?

Select TWO that apply.