ClaimCenter-Business-Analysts Exam Dumps - ClaimCenter Business Analyst - Mammoth Proctored Exam

Searching for workable clues to ace the Guidewire ClaimCenter-Business-Analysts Exam? You’re on the right place! ExamCert has realistic, trusted and authentic exam prep tools to help you achieve your desired credential. ExamCert’s ClaimCenter-Business-Analysts PDF Study Guide, Testing Engine and Exam Dumps follow a reliable exam preparation strategy, providing you the most relevant and updated study material that is crafted in an easy to learn format of questions and answers. ExamCert’s study tools aim at simplifying all complex and confusing concepts of the exam and introduce you to the real exam scenario and practice it with the help of its testing engine and real exam dumps

Which scenario shows a Business Analyst (BA) demonstrating an important way to use Guidewire's Business Process Flows during a product implementation?

An Adjuster at Succeed Insurance is handling a personal auto claim for an insured who hit a tree after swerving to avoid a child who ran into the road.

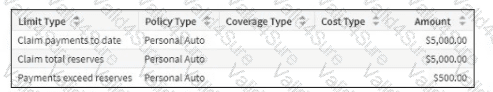

The Adjuster has this Authority Limit Profile:

The Adjuster creates a collision exposure and sets the initial reserves so that payments can be made to the insured for repairs to the damaged vehicle. No payments have been created yet.

The current financials for the claim are as follows:

Which two financial transactions will not require approval given that each option is the only transaction change rather than a cumulative change? (Choose two.)

Which two best practices should a Business Analyst (BA) follow to be prepared for a Requirements Workshop? (Choose two.)

When capturing information about a damaged vehicle, Succeed Insurance requires that the total distance driven (miles/km) for the vehicle be captured as well. What is the best practice for a Business Analyst (BA) to determine if ClaimCenter already has a field to capture distance driven?

Succeed Insurance has a strategic initiative to offer pay-as-you-drive personal auto insurance to compete with other large carriers. Customers who choose these policies

must either own a vehicle that is equipped with a monitoring device or agree to install a device provided by Succeed. The monitoring device collects information about how

the drivers of a covered vehicle drive, including how fast they drive, how hard they brake, and how many miles/kilometers the vehicle travels within a policy period.

This information is logged, and premiums are based on how the insured's driving behavior is categorized. When a claim is reported, the log files must be obtained in order to

analyze the information captured by the monitoring device at the time of the incident.

Succeed plans to collect and evaluate the Vehicle Monitoring Log files in the first implementation phase, which is scheduled for release in 60 days. The project sponsors

have instructed the implementation team to use base product functionality over customization. Integration should be leveraged where possible to avoid manual data entry.

The New Claim Wizard must capture whether or not the vehicle has a monitoring device installed when a personal auto claim is created against a pay-as-you-drive policy.

Which feature of the base product enforces this claim creation requirement?

Drivers for Rideshare companies need insurance that provides protection when they are driving the vehicle for personal reasons. This will be the Succeed Insurance standard Personal Auto Policy. However, they also need insurance to protect them from the increased risks associated with working as a Rideshare Driver. This would include when they are logged in to the Rideshare application waiting for a customer match, on their way to pick up a customer, but not when a customer has entered the vehicle.

When a driver is working as a Rideshare Driver, this new Rideshare coverage will protect them from the following types of risks, and there is a need to be able to collect the appropriate information about the losses:

. Injury to a first-party driver

. Damaged personal property of the third-party passengers

Which two exposures need to be configured? (Choose two.)

A Business Analyst (BA) has identified a new typecode essential for Succeed Insurance implementation. During adjudication, Adjusters need to be able to update the loss cause value to reflect the new typecode.

Which tabs in a Guidewire Story Card should be used to document the business requirement?